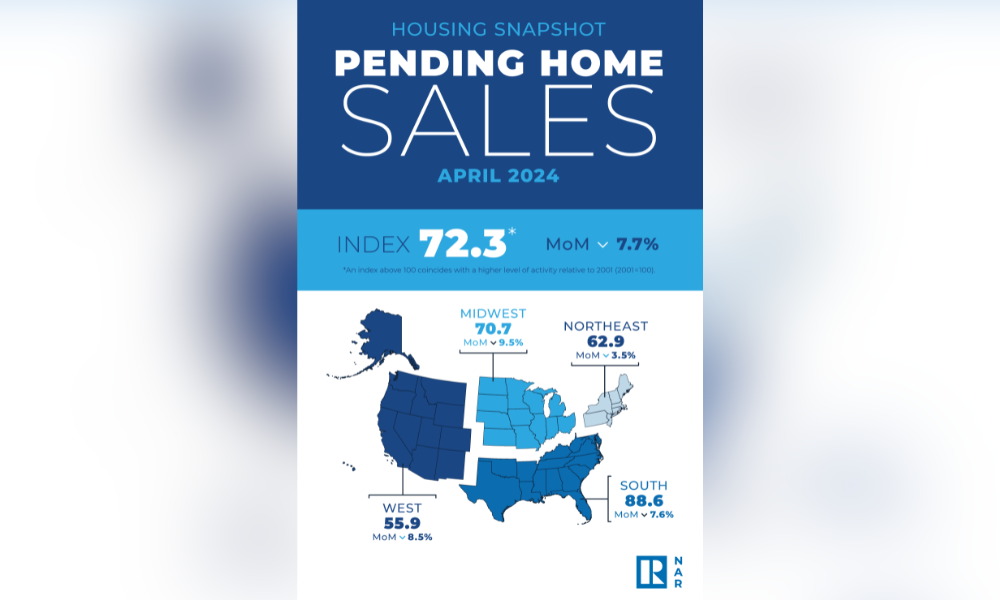

“April saw pending home sales drop 7.4% year over year, and 7.7% month over month,” said Kate Wood, home and mortgage expert at NerdWallet. “That bit of improvement we saw in March did not prove to be a turning point. With mortgage interest rates remaining relatively high, the traditional spring homebuying season may be a bit of a nonstarter this year.”

NAR chief economist Lawrence Yun blamed escalating mortgage rates for dampening home purchases despite more available inventory.

CoreLogic’s chief economist Selma Hepp highlighted a shift in homebuyer sentiment from a year ago when demand was strong.

“This time last year, potential homebuyers had the mentality to get into home buying despite high rates and a lack of homes for sale,” Hepp said. “With little expectation of interest rates going down in the near term, the mindset today is to wait and see.”

She added that rising insurance costs and climate impacts are further weighing on affordability and souring sentiment.