Still, that drop has done little to erase the eyewatering price gains of the COVID-19 pandemic, when an unanticipated market boom saw prices shoot through the roof amid feverish competition and a surge in bidding.

A signal by the Federal Reserve that it’s ready to start bringing interest rates lower might serve as a key indicator among would-be homebuyers that better times are ahead on the affordability front – but the central bank has so far proven unwilling to hint at a possible rate cut, keeping its key rate unchanged yet again in its last announcement.

Don’t expect immediate relief on the rate front, says VP

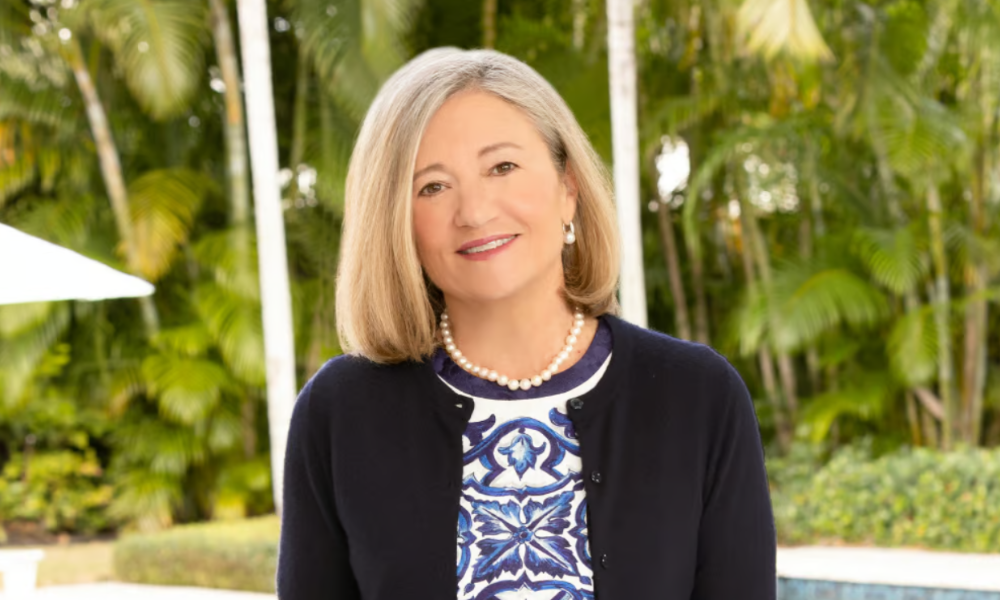

That decision by the Fed not to cut means housing and mortgage market observers are “back to data watching” as they attempt to discern when – or if – rates will start to come lower in 2024, according to Melissa Cohn (pictured top), regional vice president at William Raveis Mortgage.

She said that while falling inflation and a continuing labor market cooldown would likely see a slight dip in mortgage rates, prospective buyers shouldn’t bank on a significant drop this year.

Inflation ticked lower in May – a positive step, but one that’s unlikely to shake the overall outlook too much, according to Cohen. “If we continue to get reports such as the [last] inflation report we got… and if we see that the jobs numbers calm down, I think rates will… remain sort of where they are today, maybe go a little bit lower, but we’re not going to see any great reduction in mortgage rates,” she said.