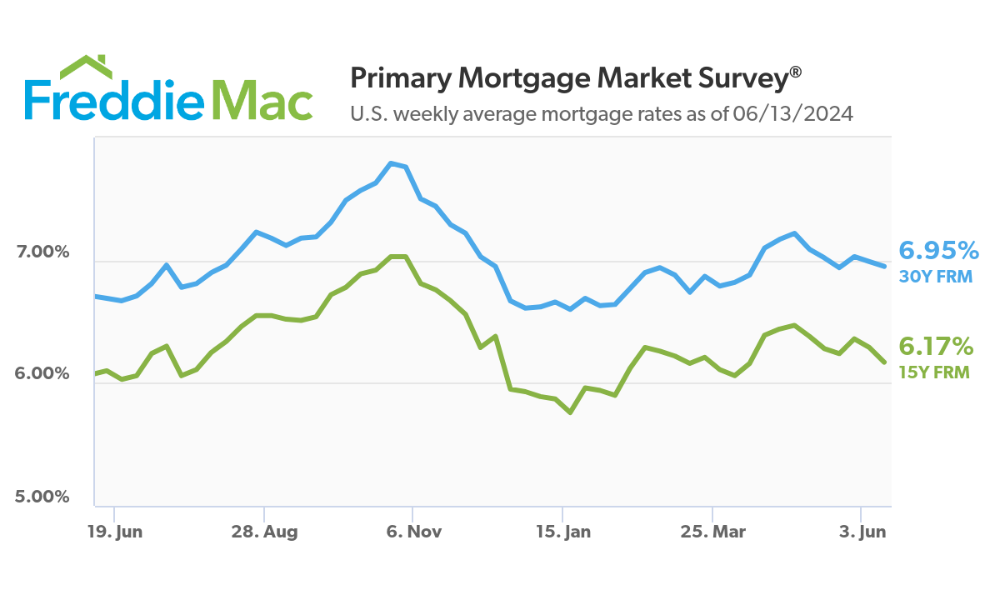

“Mortgage rates are likely to remain stubbornly above 6.5% for the rest of 2024,” Lewis said in a statement. “The Federal Reserve says it expects to cut short-term interest rates just one time this year. Three months ago, the Fed projected two rate cuts. The mortgage market might sulk the same way your dog does when you give it one treat instead of two.

“In other words, mortgage rates might move a little higher in the short term.”

The Federal Reserve’s decision to maintain the federal funds rate between 5.25% and 5.5% for the seventh consecutive time has created some uncertainty in the mortgage market. While inflation is showing signs of improvement, the central bank remained cautious about declaring victory.

“The Fed is wrangling with tenacious inflation,” said Lewis. “The consumer price index for May was lower than expected, but the Fed won’t claim success until inflation has improved several months in a row. Mortgage rates dropped slightly in the last week, but the decline doesn’t imply a long-term trend.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.