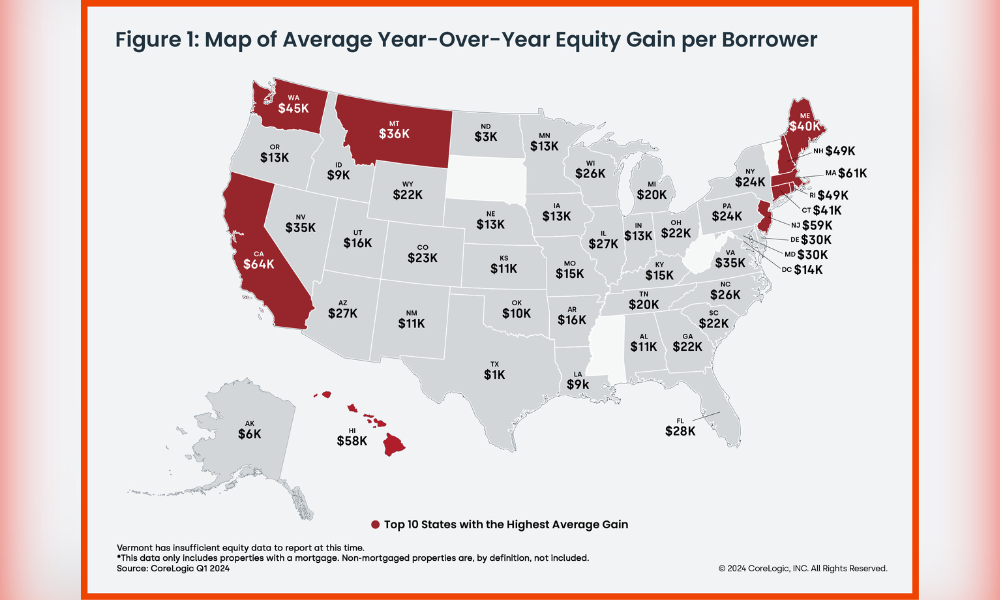

California homeowners, particularly those in the Los Angeles metro area, witnessed the most equity gains, with an average increase of $64,000 and $72,000, respectively. The Northeast also saw significant growth, with New Jersey homeowners enjoying an average equity gain of $59,000.

Continued home price growth has not only boosted overall equity but also helped many homeowners escape negative equity, a situation where the outstanding mortgage balance exceeds the property’s value.

“Higher prices have also lifted some 190,000 homeowners out of negative equity, leaving only about 1.8% of those with mortgages underwater,” Hepp said.

The report noted that low levels of negative equity are currently observed in Florida (1.1%) and Texas (1.7%), both below the national average.

“Home equity is key to mortgage holders who have seen other homeownership costs soar, including insurance, taxes and HOA fees, as a source of financial buffer,” said Hepp. “Also, low amounts of negative equity are welcomed in markets that have shown price weaknesses this spring… as further price declines could drive more homeowners to lose their equity.”

“Home equity is key to mortgage holders who have seen other homeownership costs soar, including insurance, taxes and HOA fees, as a source of financial buffer,” said Hepp. “Also, low amounts of negative equity are welcomed in markets that have shown price weaknesses this spring… as further price declines could drive more homeowners to lose their equity.”